Consumer protection as an juridical procedures

Under Article 57 of the Thai Constitution B.E. 2540, “the right of a person as a consumer shall be protected as prescribed by the laws.” The Consumer Protection Act 1979 protects the “consumer” against the “businessman” under certain conditions and limitations and prevents unjust and unfair competition. Thai persons, as well as foreigners, have the opportunity to use this strong Thai legislation as a more economical alternative to litigations at the Thai civil courts.

Thailand’s consumer protection legislation is not only applicable to routine daily business transactions, but includes foreign property investments in resort developments, villa constructions, and condo purchases as “contract-controlled business”.

Consumers, businessmen, and protection rights under the Consumer Protection Act

A consumer in the meaning of the law is

Businessman under consumer protection legislation is

- any person who buys or obtains services from a businessman;

- a person who has been offered or invited by a businessman to purchase goods or obtain services, or

- a person who duly uses goods or a person who duly receives services from a businessman even he/she is not a person who pays the remuneration.

Businessman under consumer protection legislation is

- a seller, manufacturer or importer of goods for sale;

- a purchaser of goods for resale;

- a person who renders services, and

- a person who operates an advertising business.

- the right to receive correct and sufficient information and description as to the quality of goods or services.

- the right to enjoy freedom in the choice of products or services,

- the right to expect safety in the use of goods or services,

- the right to receive a fair contract,

- the right to have the injury considered and compensated under the laws on such matters or with the provision of the Consumer Protection Act.

Professional services for foreign investors in Thailand’s industries and real estate

Civil Litigation in Thailand

With a strong dedication to client advocacy, the litigation attorneys at Juslaws and Consult are regularly called upon to handle clients’ most difficult and challenging litigation law issues.

We represent publicly held companies, privately held entities and individuals in a wide range of commercial litigation matters before federal and state courts, administrative agencies, self-regulatory organizations, and in arbitration.

Litigation Court Trial Preparation

Our Thailand litigation attorneys take a significant number of matters to trial each year. As such we are highly skilled and efficient in conducting the strategic and tactical preparations that can make or break a case.

Our litigation attorneys first perform extensive early case analysis to identify the case’s strengths and weaknesses and determine the most effective means of achieving a favorable resolution, including if litigation can or should be avoided or settlement is advisable. We understand our clients’ businesses and know how to prioritize litigation within the overall scope of their business operations. We staff based on the needs of each individual case and have the ability to draw from a deep pool of veteran litigators when stakes are high. We also leverage the latest litigation support technology to reduce client costs and improve efficiency.

Our litigation attorneys first perform extensive early case analysis to identify the case’s strengths and weaknesses and determine the most effective means of achieving a favorable resolution, including if litigation can or should be avoided or settlement is advisable. We understand our clients’ businesses and know how to prioritize litigation within the overall scope of their business operations. We staff based on the needs of each individual case and have the ability to draw from a deep pool of veteran litigators when stakes are high. We also leverage the latest litigation support technology to reduce client costs and improve efficiency.

Court Fees

| THAILAND |

COMPANY LIMITED |

BOI APPROVED |

|---|---|---|

| Ratio of Thai to Foreigner Employees | 4:1 | 0% |

| Effective Corporate Tax Rate | 4:1 | 0% |

| Foreign Ownership | 4:1 | 0% |

| Ratio of Thai to Foreigner Employees | 4:1 | 0% |

YouTube Video

Full width parallax

Since 1954, each new cabinet issues new policies to give more incentives and more support to foreign investment in Thailand. The most recent policy

Get FeedBackQuestions

What Is BOI Law In Thailand?

What expression did one of the two fathers of America?

What does a boxer do when he strikes an opponent from below?

What month is International Students Day?

Section with photo and text

The most recent policy

The State shall not allow

Thailand was the first

Key Contacts In your Language

Preparing for and Obtaining Preliminary Injunctive Relief

Injunctive relief is an important remedy sought in many types of cases, including employment, trade secret, and breach of fiduciary duty cases. Courts issue injunctive relief in order to require or prevent a party from taking certain actions in instances where monetary damages are not adequate to compensate a plaintiff for his or her injuries. Injunctive relief can be issued by a court before the case is decided on the merits in the form of a temporary restraining order (TRO) or preliminary injunction (PI). Preparing for a hearing to obtain preliminary injunctive relief can be challenging because of the generally short timeframe from the time the motion is filed to the hearing.

Thailand Appellate Lawyers

Leveraging Juslaws’s active trial practice, Juslaws and Consult maintain an active appellate law practice involving issues of significance to our clients. A case on appeal presents substantially different standards and issues than those presented at the trial level. Our litigation attorneys have extensive experience in prosecuting and responding to appeals following trial judgments. We are skilled in identifying “mistakes” and carefully formulating the issues to provide the client with the best opportunity for success.

While we routinely handle appeals on matters that we originally litigated, we also brief and argue matters handled at the trial court by other counsel. In those matters, we provide a fresh and objective perspective to each case.

We have successfully briefed and argued appeals in the appellate courts of the Kindom of Thailand

Rules, Procedure & Forms of Appels

The practice and procedure of the Court of Appeal is governed by legislation and decisions of the courts.

Procedure in civil matters is governed by the Court of Appeal Act, the Court of Appeal Rules, case law, practice directives issued by the Chief Justice and practice notes issued by the Registrar.

Procedure in criminal matters is governed by the Criminal Code, the Court of Appeal Criminal Appeal Rules, case law, practice directives issued by the Chief Justice, and practice notes issued by the Registrar.

Other statutes and rules may govern in specific situations, such as extradition and appeals and reviews from administrative bodies.

Provided below are links to various materials. These links are not official versions and may not be current. In the event that there is a question about the content of anything available through a link below, the official version takes precedence.

Arbitration and Mediation in Thailand

Array

Why is Investment Due Diligence Necessary?

Due diligence is the detailed investigation that a potential investor carries out on a target business after successfully completing preliminary negotiations with its owner.

Notwithstanding, the differences in scope due to different investing scenarios, there are typically four types of due diligence. These include commercial, legal, financial, and tax checks.

As a result of the due diligence, the investor may come to a different or more nuanced understanding of the opportunity and seek to renegotiate the initially agreed terms or even decide to decline the investment.

Due diligence commonly results in the investor negotiating additional, more detailed terms and conditions in its final agreement with the business's owner.

Notwithstanding, the differences in scope due to different investing scenarios, there are typically four types of due diligence. These include commercial, legal, financial, and tax checks.

As a result of the due diligence, the investor may come to a different or more nuanced understanding of the opportunity and seek to renegotiate the initially agreed terms or even decide to decline the investment.

Due diligence commonly results in the investor negotiating additional, more detailed terms and conditions in its final agreement with the business's owner.

What are the Steps Required for Investment Due Diligence?

Due diligence begins after an investment has been initiated via a letter of intent, or term sheet. At this point, a team is assembled to conduct the exercise with relevant rules of engagement agreed between both parties.

Investment due diligence is usually taken over a period of between 30 and 60 days.

In the end, a report will be compiled and presented to the investor with recommendations of potential additional terms and conditions to be required in the transaction.

Investment due diligence is usually taken over a period of between 30 and 60 days.

In the end, a report will be compiled and presented to the investor with recommendations of potential additional terms and conditions to be required in the transaction.

Types of Investment Due Diligence

Investment due diligence does not have a strict formulation; it should be designed to address the specific circumstances. The matters which will be investigated depend on the structure of the contemplated transaction - what the investor will receive in exchange for its investment. If the transaction is structured so that certain assets, liabilities or segments of the business are excluded, there usually is no reason for the investigation to cover them.

Due diligence will include commercial, legal, financial and tax due diligence

1. Commercial due diligence covers the target business’s market positioning and market share, including drivers and prospects. It seeks to obtain an independent perspective on the sales forecast as the most critical component of the target’s business plan.

2. Legal due diligence covers a wide scope of legal matters, including proper incorporation and ownership, contractual obligations, ownership of assets, compliance and litigation. It seeks to confirm the validity of the rights being acquired by the investor and the absence of legal risks which could undermine the value of the investment.

3. Financial due diligence has a wider perspective because it seeks to both:

- Validate the investor’s valuation assumptions by looking at historical performance, if available, and concluding whether it is consistent with projections, and

- Identify financial uncertainties and exposures which could disrupt the business, or result in additional costs to the investor.

4. Tax due diligence could be viewed as an extension of the financial due diligence, where the focus is on identifying potential additional tax liabilities arising from non-compliance or errors.

Further types of investment due diligence are technical, environmental and regulatory, performed when the impact of these areas on the business is significant. Depending on the situation, the due diligence may need to address very specific and narrowly defined topics, as long as they are factors for the valuation and assessment of the risks of the investment opportunity.

2. Legal due diligence covers a wide scope of legal matters, including proper incorporation and ownership, contractual obligations, ownership of assets, compliance and litigation. It seeks to confirm the validity of the rights being acquired by the investor and the absence of legal risks which could undermine the value of the investment.

3. Financial due diligence has a wider perspective because it seeks to both:

- Validate the investor’s valuation assumptions by looking at historical performance, if available, and concluding whether it is consistent with projections, and

- Identify financial uncertainties and exposures which could disrupt the business, or result in additional costs to the investor.

4. Tax due diligence could be viewed as an extension of the financial due diligence, where the focus is on identifying potential additional tax liabilities arising from non-compliance or errors.

Further types of investment due diligence are technical, environmental and regulatory, performed when the impact of these areas on the business is significant. Depending on the situation, the due diligence may need to address very specific and narrowly defined topics, as long as they are factors for the valuation and assessment of the risks of the investment opportunity.

How Does it Actually Work?

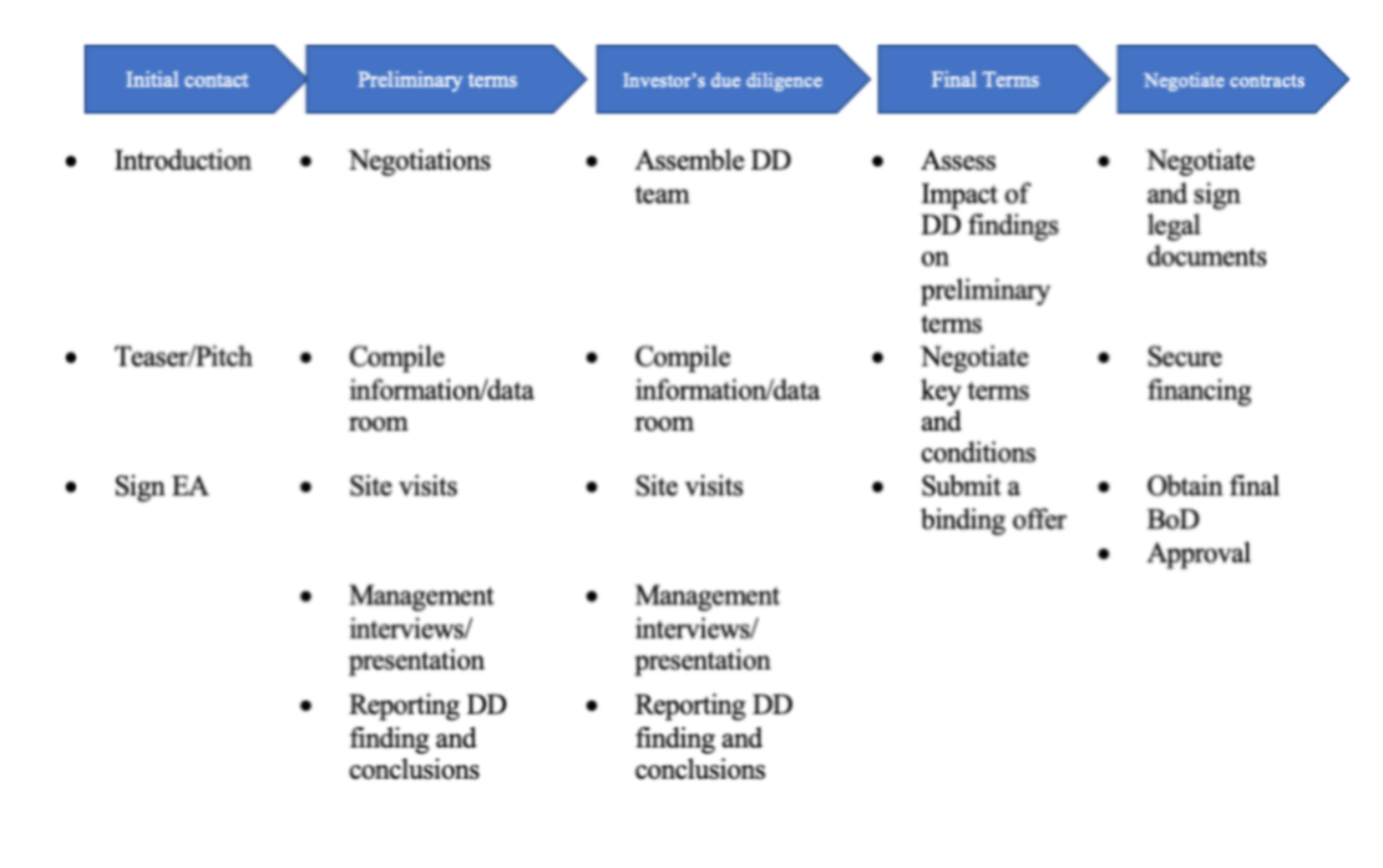

Investor due diligence typically takes a central position along the timeline of the investment process, as illustrated by the chart below

1. The potential investor has expressed its interest in the opportunity presented by the investee (founder, business owner, supplier, etc.).

2. The two sides have met and established a relationship, discussed the opportunity, and agreed in principle on the key terms of the investment (transaction).

3. The key terms agreed in the preliminary stage typically include transaction structure (what does the investor receive?), Price (what does the investor pay?) And process (what steps must be completed to close the transaction?). Frequently, such terms are laid out in a non-binding document called a Letter of Intent, Term Sheet or Memorandum of Understanding.

Process of Due Diligence

• The investor and the investee agree on the terms of access to information about the target business, including confidentiality undertakings, scope, and limitations of the investigation, communication protocol and points of contact.

• A timeline is established including deadlines for receiving the information, issuing the investment due diligence report (s) and returning to the negotiating table.

• Information requesting and receiving.

• Project / Site visits at the target business by the due diligence team.

• Internal communication and discussion of findings.

• Preparation of one or more investment due diligence reports.

• Discussion of the report with the investor.

• Our lawyers will put the investment due diligence findings on the table in order to negotiate the changes or additions to the terms of the transaction.

• A timeline is established including deadlines for receiving the information, issuing the investment due diligence report (s) and returning to the negotiating table.

• Information requesting and receiving.

• Project / Site visits at the target business by the due diligence team.

• Internal communication and discussion of findings.

• Preparation of one or more investment due diligence reports.

• Discussion of the report with the investor.

• Our lawyers will put the investment due diligence findings on the table in order to negotiate the changes or additions to the terms of the transaction.

Property Due Diligence

Purchasing and owning real estate is always a high risk whether it is a single-family home that you will occupy or a 50-unit apartment building for income. You have heard experts say to make sure to “do your due diligence” when buying property, but what does that actually mean?

What are Property Due Diligence Services?

Buying property in Thailand requires more care and investigation than is needed in more developed countries with extensive regulations and long-established title record systems.

Property Due Diligence means reviewing legal documents and government records, and taking other necessary steps that help you to be sure before you actually make the purchase. If there are too many issues with the property and that means too much potential risk and cost, then you can cancel your purchase agreement and look for a better property.

Why use our Investigation Services before buying any Property in Thailand?

1. Make sure that you are dealing directly with the owner.

2. Verify the issuance of a Title Deed for the property.

3. Find out if the property and land are subject to court actions.

4. Determine last sale price and current market values.

5. Investigate whether the chain of title has questionable transactions.

6. Confirm that the property is not subject to mortgage liens or encumbrances of record.

7. Check compliance with zoning, environmental and building regulations.

8. Confirm that the Title Deed is the correct type and the land area conforms with the seller’s representations.

9. Determine whether the land is improperly titled public forest land, or if it has use or transfer restrictions under the land reform laws.

2. Verify the issuance of a Title Deed for the property.

3. Find out if the property and land are subject to court actions.

4. Determine last sale price and current market values.

5. Investigate whether the chain of title has questionable transactions.

6. Confirm that the property is not subject to mortgage liens or encumbrances of record.

7. Check compliance with zoning, environmental and building regulations.

8. Confirm that the Title Deed is the correct type and the land area conforms with the seller’s representations.

9. Determine whether the land is improperly titled public forest land, or if it has use or transfer restrictions under the land reform laws.

Property and Land Title Deed Verification Report will include:

• Verification of the Title Deed with the official record retained in Land Office.

• Provide the name of the owner, building and land areas, and official encumbrances recorded with government.

• Provide English translation of the Title Deed.

• Provide a PDF copy of Land Title.

• Provide the name of the owner, building and land areas, and official encumbrances recorded with government.

• Provide English translation of the Title Deed.

• Provide a PDF copy of Land Title.

Residential Property Due Diligence Report :

• Verify the Title Deed with the official record retained in Land Office.

• Provide the name of the owner, building and land areas, and official encumbrances recorded with government.

• Provide English translation of the Title Deed.

• Provide a PDF copy of Land Title.

• Provide last registered sale price.

• Provide an official survey map.

• Check Title Deed history.

• Check pending legal actions.

• Provide photos.

• Provide a certified copy of the Title Deed.

• Provide approximate market price.

• Verify the registration of condominium juristic person (for condo unit).

• Provide the name of the owner, building and land areas, and official encumbrances recorded with government.

• Provide English translation of the Title Deed.

• Provide a PDF copy of Land Title.

• Provide last registered sale price.

• Provide an official survey map.

• Check Title Deed history.

• Check pending legal actions.

• Provide photos.

• Provide a certified copy of the Title Deed.

• Provide approximate market price.

• Verify the registration of condominium juristic person (for condo unit).

Land Complete Due Diligence Report includes:

• Verify the Title Deed with the official record retained in Land Office.

• Provide the name of the owner, area of the land, official encumbrances recorded with government.

• Provide English translation of Title Deed.

• Provide a PDF copy of Land Title.

• Provide last registered sale price.

• Official survey map.

• Confirm the existence of access ways.

• Zoning restrictions.

• Provide history details of the land.

• Confirm that the property is not in a national forestry reserve or land reform area.

• Check pending legal actions.

• Provide photos of the Land.

• Provide a certified copy of Land Title.

• Provide approximate market price.

• Provide the name of the owner, area of the land, official encumbrances recorded with government.

• Provide English translation of Title Deed.

• Provide a PDF copy of Land Title.

• Provide last registered sale price.

• Official survey map.

• Confirm the existence of access ways.

• Zoning restrictions.

• Provide history details of the land.

• Confirm that the property is not in a national forestry reserve or land reform area.

• Check pending legal actions.

• Provide photos of the Land.

• Provide a certified copy of Land Title.

• Provide approximate market price.

Questions for Property and Land Due Diligence

Q. What is Title Deed due diligence?

Q. How long does Property Due Diligence take?

Lease Agreements Due Diligence

There are many numbers of searches and inquiries that can be made to complete due diligence in any type of transaction, including negotiating lease documentation. The nature of the lease arrangement will shape the extent of the due diligence that is required in a particular transaction. Below is a summary of a number of searches that are commonly considered when conducting lease due diligence.

Title Search

A search of title may be completed to confirm the legal description of the property and to ensure that the landlord owns the property.

Where the landlord is a property manager or some other entity that is not the owner of the property, you may want to consider including a representation in the lease agreement that the particular entity has the authority to act on behalf of the landlord with respect to the negotiation and execution of the lease.

Alternatively, a tenant may request a written confirmation by the landlord that the other entity is authorized to act as its agent for the purpose of entering into the lease.

A search of the property may also reveal if there are any use restrictions that may limit the anticipated use by a tenant. It is important to note that not all tenants register an exclusive right on title. A tenant should request a list of any exclusive uses from the landlord at the offer stage. There are situations where an existing tenant with an exclusive use may grant an exception to an incoming tenant. Any such exception should be documented by obtaining an authorization from the existing tenant with the exclusive use and the lease should reflect the exception as well.

If any mortgages, charges, liens, or other security interest appear on the search of title, a tenant should consider requesting that the landlord obtain a Non-Disturbance Agreement from the secured party. An existing mortgagee has priority and could refuse to recognize a subsequent lease. A Non-Disturbance Agreement provides comfort to the tenant in situations where the mortgagee enforces upon its security as the Non-Disturbance Agreement provides that the mortgagee will not disturb or interfere with the tenant's possession or other rights of the tenant under the lease so long as the tenant is not in default.

A search may also reveal if there are any construction liens or default on taxes, which gives the tenant insight into the financial position of the landlord.

Corporate Searches (Thai Company Due Diligence)

Corporate searches can be completed against both the landlord and the tenant to ensure the proper spelling of names and that the company is an active company. It may be that the landlord or the tenant is a partnership.

Zoning and purpose of use

A search of the current zoning by-law, any site-specific zoning by-laws, and the official plan can be completed to determine what uses are permitted on a specific property and also those uses that are prohibited. When completing zoning searches, be aware of both the primary use of the space and any ancillary uses. Certain provisions within the lease may have to be modified to permit ancillary use(s) of premises.

Where the tenant will be leasing space in a building or development that has been in existence for some time and its use will be identical to other tenants in the location, often the tenant will not want to incur the cost of completing a review of the applicable zoning legislation. However, when dealing with newly constructed buildings, a review of relevant zoning legislation may be appropriate as a tenant cannot take comfort in the fact that it will be using the premises for the same use as a previous tenant or other existing tenants in the location.

Additionally, when a tenant is leasing space in a newly constructed space, the tenant may want to make inquiries with the landlord regarding the party responsible for development charges or costs for other infrastructure.

This information will be important when the parties are negotiating the operating cost section of the lease

A tenant should consider the condition of the building itself as part of its due diligence. An inquiry can be made to the local building department to determine if there are any open permits for work being completed on or in the building. If there are open permits, a tenant may want to make sure the permit does not apply to its premises, especially where the tenant will be completing improvements that may require its own permit. Additionally, where a tenant will make significant improvements to the premises, the tenant may want to make inquiries with the local building department to ensure that such improvements are permitted.

Where the tenant will take premises as-is or will be responsible for the repair, maintenance, and replacement of the premises or parts of the building, the tenant will want to be aware of any major repairs that may need to be completed and how much such repairs will cost. If a tenant agrees to take on repair and maintenance obligations with respect to any capital constructions (eg roof, loading docks, HVAC, doors, etc.), a tenant should consider making inquiries with the landlord to ensure that any warranties or guarantees are transferrable to the tenant.

Where the tenant will take premises as-is or will be responsible for the repair, maintenance, and replacement of the premises or parts of the building, the tenant will want to be aware of any major repairs that may need to be completed and how much such repairs will cost. If a tenant agrees to take on repair and maintenance obligations with respect to any capital constructions (eg roof, loading docks, HVAC, doors, etc.), a tenant should consider making inquiries with the landlord to ensure that any warranties or guarantees are transferrable to the tenant.

Lease Disputes

Because most commercial leases are for 5, 10, or even 30 years, the length of time you will be bound by the lease terms warrants hiring legal counsel to look after your best interests. This is equally important in a residential setting, as housing costs are generally the largest monthly or yearly expenditure. From both the landlord’s and tenant’s perspectives, it is important to clearly and thoroughly set forth the terms of the agreement, whether it is a residential or commercial lease, to avoid disputes as to each party’s responsibilities and obligations.

The most common issues that create disputes with lease agreements include:

1. Condition of the property was not thoroughly investigated.

2. Unclear conditions of the responsible party for maintenance and repairs.

3. Unclear conditions about the type and amount of insurance required to be obtained by each party.

4. Notice and cure periods, as well as when late fees are triggered, are not clearly stated.

5. The language is not clear as to how the tenant may exercise an option for the lease term to be extended, known as a renewal option, nor does the lease clearly provide the rent for the renewal option and what happens if the parties cannot agree upon the new rent amount.

6. The lease was not signed as required by law or an authorized representative did not sign the lease.

7. Language does not address who owns alterations or improvements made to the property.

8. Unclear language as to if either party is obligated to repair or rebuild in event of partial or total destruction, or when a party has the right to terminate the lease in the event of destruction.

9. Failure to clearly state the conditions to be satisfied for the security deposit to be returned to the tenant.

10. If the tenant is given an option to purchase, the language fails to clearly provide the terms and conditions of said option and whether tenant’s deposit for the option is non-refundable.

Be extra cautious when negotiating a lease with an option to purchase. An option to purchase requires the parties to not only set forth the terms and conditions to lease the premises, but also requires all terms and conditions of a contract be discussed and clearly set forth in the lease. Often the option to purchase provision is not properly drafted and is a common cause for legal disputes.

The value of thorough due diligence cannot be underestimated by either party before entering into a lease agreement. For instance, is the tenant creditworthy and has a background check on tenant been obtained? Is the landlord responsive when repairs are required? Is the landlord financially sound or is there a pending foreclosure or other lawsuits against the landlord?

In the event, a dispute arises, be sure to contact our legal counsel as soon as possible to protect your interests.

2. Unclear conditions of the responsible party for maintenance and repairs.

3. Unclear conditions about the type and amount of insurance required to be obtained by each party.

4. Notice and cure periods, as well as when late fees are triggered, are not clearly stated.

5. The language is not clear as to how the tenant may exercise an option for the lease term to be extended, known as a renewal option, nor does the lease clearly provide the rent for the renewal option and what happens if the parties cannot agree upon the new rent amount.

6. The lease was not signed as required by law or an authorized representative did not sign the lease.

7. Language does not address who owns alterations or improvements made to the property.

8. Unclear language as to if either party is obligated to repair or rebuild in event of partial or total destruction, or when a party has the right to terminate the lease in the event of destruction.

9. Failure to clearly state the conditions to be satisfied for the security deposit to be returned to the tenant.

10. If the tenant is given an option to purchase, the language fails to clearly provide the terms and conditions of said option and whether tenant’s deposit for the option is non-refundable.

Be extra cautious when negotiating a lease with an option to purchase. An option to purchase requires the parties to not only set forth the terms and conditions to lease the premises, but also requires all terms and conditions of a contract be discussed and clearly set forth in the lease. Often the option to purchase provision is not properly drafted and is a common cause for legal disputes.

The value of thorough due diligence cannot be underestimated by either party before entering into a lease agreement. For instance, is the tenant creditworthy and has a background check on tenant been obtained? Is the landlord responsive when repairs are required? Is the landlord financially sound or is there a pending foreclosure or other lawsuits against the landlord?

In the event, a dispute arises, be sure to contact our legal counsel as soon as possible to protect your interests.

What is Due Diligence in Thailand?

Due diligence is an investigation or audit of a potential investment or product to confirm all important facts, which might include the review of financial records. Due diligence refers to the research done before entering into an agreement or a financial transaction with another party, or before commencing legal actions.

Importance of Due Diligence

Transactions that undergo a due diligence process offer higher chances of success. Due diligence contributes to making informed decisions by enhancing the quality of information available to decision-makers.

From a buyer’s perspective

Due diligence allows the buyer to feel more comfortable that his or her expectations regarding the transaction are correct. In mergers and acquisitions (M&A), purchasing a business without doing due diligence substantially increases the risk to the purchaser.

From a seller’s perspective

Due diligence is conducted to provide the purchaser with trust. However, due diligence may also benefit the seller, as going through the rigorous financial examination may, in fact, reveal that the fair market value what is being sold is more than what was initially thought to be the case. Therefore, it is not uncommon for sellers to prepare due diligence reports themselves prior to potential transactions.

Reasons For Due Diligence

There are several reasons why due diligence is conducted:

• To confirm and verify information that was brought up during the deal or investment process

• To identify potential defects in the deal or investment opportunity and thus avoid a bad business transaction

• To obtain information that would be useful in valuing the deal

• To make sure that the deal or investment opportunity complies with the investment or deal criteria

• To confirm and verify information that was brought up during the deal or investment process

• To identify potential defects in the deal or investment opportunity and thus avoid a bad business transaction

• To obtain information that would be useful in valuing the deal

• To make sure that the deal or investment opportunity complies with the investment or deal criteria

Costs of Due Diligence

The costs of undergoing a due diligence process depend on the scope and duration of the effort, which depends heavily on the complexity of the subject matter. Costs associated with due diligence are an easily justifiable expense in view of the risks associated with failing to conduct due diligence. Parties involved in the deal determine who bears the expense of due diligence. Both buyer and seller typically pay for their own team of investment advisors, accountants, attorneys and other consulting personnel.

What types of Due Diligence can be conducted in Thailand?

Depending on the client’s needs, our Thai lawyers can conduct the following company due diligence proceedings:

• Legal Due Diligence

• Financial Due Diligence

• Commercial Due Diligence

Although these have traditionally been distinct, the best due diligence programs maintain an element of close cooperation as the work in one area can often inform the checks being carried out elsewhere. Many practices now offer an integrated service that brings these strands together.

• Legal Due Diligence

• Financial Due Diligence

• Commercial Due Diligence

Although these have traditionally been distinct, the best due diligence programs maintain an element of close cooperation as the work in one area can often inform the checks being carried out elsewhere. Many practices now offer an integrated service that brings these strands together.

Legal Due Diligence

Legal Due Diligence seeks to examine the legal basis of a transaction, for example, to ensure that a target business holds or can exercise the intellectual property rights that are crucial to the future success of the company or to determine that the business has all necessary licenses as per Thai law.

Legal Due Diligence often includes a thorough verification of the company’s situation with respect to liabilities towards thirds parties or if the entity is involved in any litigation.

Other areas that would most likely be explored include:

• Legal structure

• Contracts

• Loans

• Property

• Employment

• Pending litigation

Legal Due Diligence often includes a thorough verification of the company’s situation with respect to liabilities towards thirds parties or if the entity is involved in any litigation.

Other areas that would most likely be explored include:

• Legal structure

• Contracts

• Loans

• Property

• Employment

• Pending litigation

Financial Due Diligence

With respect to Financial Due Diligence, our Thai lawyers can review a company’s records, accounting system, and its audited financial statements to locate material abberations.This would be expected to consider areas such as:

• Earnings

• Assets

• Liabilities

• Cash flow

• Debt

• Management

Commercial Due Diligence

Commercial Due Diligence will focus on the products and services the company offers.

Commercial Due Diligence considers the market in which a business sits, for example involving conversations with customers, an assessment of competitors and a fuller analysis of the assumptions that lie behind the business plan. All of this is intended to determine whether the business plan stands up to the realities of the market.

Commercial Due Diligence considers the market in which a business sits, for example involving conversations with customers, an assessment of competitors and a fuller analysis of the assumptions that lie behind the business plan. All of this is intended to determine whether the business plan stands up to the realities of the market.

Company Due Diligence in Thailand

Company Due Diligence can imply an extensive search on a business which means a longer period of time will be required. Also, when it comes to complex transactions, the procedure will require more resources and complicated searches. Our Thai representatives can provide clients with customized company due diligence services in order to cover all aspects such procedures imply.

Why request the services of specialists for Company Due Diligence in Thailand?

Foreign investors doing business in Thailand use due diligence procedures on the companies under consideration for a business transaction. Company due diligence implies the process of evaluating a business from various points of view.

Depending on the purpose of the investigation of a company or business you can order a general due diligence review, where the report will disclose only the main registration information, or an extended due diligence, where it will be possible to obtain financial information translated into English , litigation information and a full set of registration documents from the government department.

Depending on the purpose of the investigation of a company or business you can order a general due diligence review, where the report will disclose only the main registration information, or an extended due diligence, where it will be possible to obtain financial information translated into English , litigation information and a full set of registration documents from the government department.

Company Verification Services include information as follows:

• Company Status

• Official Company Name

• Registration Number

• Type of Entity

• Date of Establishment

• Registered Capital

• Registered Address

• Branch Address

• Main Objective of the Company

• Name of Director (s)

• Authorization of Director (s)

A Company Due Diligence Report will include the following information:

• Company Status• Official Company Name

• Registration Number

• Type of Entity

• Date of Establishment

• Registered Capital

• Registered Address

• Branch Address

• Name of Director (s)

• Authorization of Director

• Main Objective of the Company

• Company Shareholder List

• Paid-up Capital

• General Financial Information based on DBD data

• Scan of Government Company Affidavit in Thai and English languages

What you will get with Extended Company Due Diligence in Thailand :

• Litigation information to identify any court actions against the company (if applicable, providing details including court name, date, case number and claim amount)

• Scan copies of Certified Company Government Corporate Documents and English Translation, including additional information (if necessary)

• Scanned copy of Articles of Association

• All history of changes to registration details

• Financial Statement and Balance Sheet (last submitted to DBD)

• Notes to Financial Statement (last submitted to DBD)

• Audit Report attached to Financial Statement (last submitted to DBD)

• Shareholding Structure

• Scan copies of Certified Company Government Corporate Documents and English Translation, including additional information (if necessary)

• Scanned copy of Articles of Association

• All history of changes to registration details

• Financial Statement and Balance Sheet (last submitted to DBD)

• Notes to Financial Statement (last submitted to DBD)

• Audit Report attached to Financial Statement (last submitted to DBD)

• Shareholding Structure

Company Due Diligence Sample Report

Our reports will be in English and will be sent to in PDF format. We will also translate Thai documents to English pursuant to your order.

Questions for Company Due Diligence Services

Q: How long will it take to get my report?

Q. Where does the information come from?

Q. How long is the verification valid for?

Q. What information do I need to provide in order to get a Due Diligence Report?

Q. Can I order an Extended Due Diligence report later?

Q. What happens if the company is not registered?

Q. How can I pay for Due Diligence?

Q. Why did I fail to receive my report?

Q. Will the company know they have been checked?

Q. Can I see a sample report?

Q. I cannot find the answer to my question here, what should I do?

Commercial Contracts Due Diligence

In the for-profit and non-profit worlds, contracts are written to document deals and allocate risks between parties every day. The range of types of commercial contracts or agreements is extremely broad, but in every type of contract, basic steps can be taken to effectively document the arrangement while protecting your interests.

While due diligence is often thought of in the context of mergers and acquisitions, real estate or finance, due diligence is important to conduct before entering any new contractual relationship. To begin, know who you are dealing with. Awareness of the parties and the business arrangement is a must to effectively evaluate the business risks and legal risks of the deal.

While due diligence is often thought of in the context of mergers and acquisitions, real estate or finance, due diligence is important to conduct before entering any new contractual relationship. To begin, know who you are dealing with. Awareness of the parties and the business arrangement is a must to effectively evaluate the business risks and legal risks of the deal.

Do you know the party or parties you are dealing with?

If not, begin with research and gather information, including from the party itself, to gain an appreciation for who they are and how they operate.

Has your company ever done business with this party before?

If so, take time to look at the previous contract and take into consideration how the parties have operated historically. In the due diligence process, examine the party’s record, how long have they been in business, information from referral sources, background checks, prior services provided and / or products delivered and whether they were timely and within budget.

Once you have established an understanding of the party or parties, you can use this knowledge to examine the elements of the business deal and evaluate the risk. Conducting due diligence before entering an agreement is a prudent and important step to identifying business risks and legal risks, both of which need to be carefully reviewed by the business stakeholders as well as legal counsel to document the deal in an appropriate manner.

Once you have established an understanding of the party or parties, you can use this knowledge to examine the elements of the business deal and evaluate the risk. Conducting due diligence before entering an agreement is a prudent and important step to identifying business risks and legal risks, both of which need to be carefully reviewed by the business stakeholders as well as legal counsel to document the deal in an appropriate manner.

Terms and conditions in the commercial contract

The conditions vary depending on the business and type of agreement, but these features need to be understood as part of the risk analysis. In the end, the degree of due diligence varies from deal to deal and rests on various circumstances. Exercising some basic degree of proper and reasonable care to investigate a business or person prior to signing a contract needs to be part of any deal.

A purchaser should always ensure that there is a condition precedent in the sale agreement regarding the successful completion of legal due diligence to the satisfaction of the purchaser. This will ensure that the purchaser has an exit opportunity from the sale agreement if the legal due diligence results are not satisfactory to the purchaser.

A prudent purchaser should utilize the results of a due diligence investigation as a negotiation tool in the transaction. For instance, any potential liabilities discovered (such as tax liabilities, litigation, outstanding amounts due by debtors, fines / penalties imposed) can be used as a pricing chip to reduce the amount of the purchase price.

Where risks have been identified, the seller could provide warranties or indemnities to protect the purchaser from any future liabilities which may arise from these risks. Where consents and approvals are required, to assign contracts or licenses or in relation to change of control provisions or pre-emptive rights, these can be incorporated as conditions precedent in the sale and purchase agreement. Furthermore, where specific issues require action by the seller prior to the implementation of the transaction, these may also be added as conditions precedent in the sale and purchase agreement.

Whereas contracts often list failure conditions and any associated penalties, you need to ensure that the contract is correct from your point of view, i.e., it is adequately protected.

Our services will help you to be sure that each of these agreements is signed by a duly formed Thailand company and by the legal representative of these Thai companies, that the names and addresses are in accord with the information registered in the Thailand Department of Business Development (DBD), and that the formal company seal is used to sign the agreements.

A purchaser should always ensure that there is a condition precedent in the sale agreement regarding the successful completion of legal due diligence to the satisfaction of the purchaser. This will ensure that the purchaser has an exit opportunity from the sale agreement if the legal due diligence results are not satisfactory to the purchaser.

A prudent purchaser should utilize the results of a due diligence investigation as a negotiation tool in the transaction. For instance, any potential liabilities discovered (such as tax liabilities, litigation, outstanding amounts due by debtors, fines / penalties imposed) can be used as a pricing chip to reduce the amount of the purchase price.

Where risks have been identified, the seller could provide warranties or indemnities to protect the purchaser from any future liabilities which may arise from these risks. Where consents and approvals are required, to assign contracts or licenses or in relation to change of control provisions or pre-emptive rights, these can be incorporated as conditions precedent in the sale and purchase agreement. Furthermore, where specific issues require action by the seller prior to the implementation of the transaction, these may also be added as conditions precedent in the sale and purchase agreement.

Whereas contracts often list failure conditions and any associated penalties, you need to ensure that the contract is correct from your point of view, i.e., it is adequately protected.

Our services will help you to be sure that each of these agreements is signed by a duly formed Thailand company and by the legal representative of these Thai companies, that the names and addresses are in accord with the information registered in the Thailand Department of Business Development (DBD), and that the formal company seal is used to sign the agreements.

Common types of commercial contracts

Our lawyers draft a range of contracts for businesses in a wide range of industries. Some of these agreements are internal, between the owners of a business (such as shareholder or partnership agreements). Others are between businesses and external stakeholders (like supply or service agreements).

Common contracts include:

• Sale or purchase of a business

• Shareholder agreements

• Partnership agreements

• Supply agreement

• Employment agreements;

• Standard terms and conditions for sale of goods and services

• Joint venture agreements

• Confidentiality agreements or non-disclosure deeds

• License agreements

• Distribution agreements

• Privacy policies

• Website terms of use

• Commercial leases

• Franchise agreements

• Loan agreements

• Plant and equipment leases, etc.

Looking for something that is not on this list? We are able to draft, review and advise on all types of business contracts. Contact us to find out what assistance we can provide you for other contracts.

• Shareholder agreements

• Partnership agreements

• Supply agreement

• Employment agreements;

• Standard terms and conditions for sale of goods and services

• Joint venture agreements

• Confidentiality agreements or non-disclosure deeds

• License agreements

• Distribution agreements

• Privacy policies

• Website terms of use

• Commercial leases

• Franchise agreements

• Loan agreements

• Plant and equipment leases, etc.

Looking for something that is not on this list? We are able to draft, review and advise on all types of business contracts. Contact us to find out what assistance we can provide you for other contracts.

Questions - Contracts Review

Q. Which legal documents should be reviewed?

Q. What type of documents can be reviewed?

Q. Why do contracts need to be drafted/revised by a Thai lawyer?

How can our Thai lawyers help?

We can assist you with proposed or existing contracts by:

1.Drafting new contracts

2.Drafting variations to contracts

3.Reviewing and advising on your obligations or risks arising under agreements

4.Advising on the enforceability of agreements

5.Taking steps to enforce breached agreements

Get in contact with us today if you want to discuss how we can assist you with your business agreements.

1.Drafting new contracts

2.Drafting variations to contracts

3.Reviewing and advising on your obligations or risks arising under agreements

4.Advising on the enforceability of agreements

5.Taking steps to enforce breached agreements

Get in contact with us today if you want to discuss how we can assist you with your business agreements.

Thailand Construction Law

Overview Property Law Thailand

Thailand has similar property laws and regulations as western countries as the Thailand Civil Code is based on the mainland European civil law system and copied aspects from common law countries. Thai property laws are considered western. What makes buying real estate in Thailand different and more complicated for non-Thai nationals is that Thai land laws prohibit every foreigner from owning land making it impossible for foreigners to obtain outright ownership over land and house in Thailand.

What is a Property Dispute?

A property dispute refers to any legal dispute involving real property, also known as real estate. Real property is immoveable property attached directly to the land. Real property includes single-family homes, condominiums, apartments, ponds, canals, and roads.

Parties to Property Disputes

Common Types of Property Disputes

Here’s what will happen during your consultation:

Over the course of thousands of client interviews, we have honed and refined our consultation process to maximize the benefits to our clients. Virtually every consultation (whether via telephone, Skype, or in person) follows the same 4-step process, which takes about 30-60 minutes depending on the complexity of the case. We can, however, adapt to any situation. Rest assured, regardless of the circumstances, we will walk you through the process step by step so you know exactly what to expect.

STEP 1: Collection of Information about You to Help You Better

The first step in the process is to gather some personal and identifying information about you. There are three main reasons to collect this information:

First, it is important that we have clear and direct lines of contact and communication so things like email, address, and phone number are essential.

Second, the Law Society requires that we collect basic information about our clients.

Third, and perhaps most importantly, we want to understand you better so we can better help you. Remember that the police and prosecutor likely know nothing about you beyond your name, age, and what you’re charged with. Our job is to show the best side of you and show the real person behind the allegations.

Although some people are understandably concerned about revealing personal information to anyone, rest assured anything you say is confidential and held to the highest privacy standards.

STEP 2: Review of Court Documents

The second step in the process is a careful review of all your court documents (and any other documents you might want to show us that may impact your case). Everyone charged with an offence has at least some basic court documents given to them by the police. It is important to review those documents in detail to ensure we know (and you know) what they say. Specifically, we look for three core components:

First, your documents will indicate exactly what you’re charged with. Sometimes, people see just a number but don’t understand what it means, and sometimes they see only one charge listed, but there may actually be multiple charges included. In either case, once we know for sure what the charges are, we can address the situation appropriately.

Second, your documents will indicate when you are required to attend court and/or fingerprinting. Many times, people confuse the court date with the fingerprinting date, and vice-versa. Sometimes, people come to see us and realize they have missed a required appearance and a warrant has been issued for their arrest. No matter what the situation, we can take care of it.

Third, your documents will list what conditions/restrictions you are bound by. It is not uncommon for people to misinterpret their conditions, or not realize there are any conditions at all. We carefully review each and every condition to ensure they are manageable, and if not, come up with a plan to change/remove them.

There may be other documents provided by police from time to time (like in DUI cases), or other documents that you might bring along with you, that are important to review. It is important to note that this process is not a substitute for a careful and thorough review of “disclosure”, which is the extensive police information package provided by the Crown Prosecutor’s office. A detailed review of disclosure occurs subsequent to the initial consultation and is part of the second stage comprehensive investigation of the case.

STEP 3: Review of What Happened

The third step in the process is to fully understand what happened through your eyes. Whenever possible, and if you haven’t already done so, we will try to distill your storyline to writing.

Generally, we want to understand the background and lead up to the allegations. Sometimes it’s as simple as understanding what happened earlier in the day; sometimes it’s important to understand what transpired weeks or even years leading up to the charges.

Next, we want to understand what actually happened. That is, what were the step-by-step words and actions taken by everyone involved. Think of it almost like a script to a movie; the more detail, the better.

Finally, it is important to understand what happened after the alleged offence. Was there further contact with the complainant? Were you questioned by the police? Did any new information come to light since the incident?

This part of the process typically takes the longest to go through during a consultation. Sometimes the case is more complex than what can possibly be covered during a 1-hour consultation. In such circumstances, we may want to schedule a follow-up meeting or ask you to provide further information in due time. To maximize our chances of getting through everything, we would encourage you to write/type out everything you can think of related to the incident so we can focus on filling the gaps, rather that writing everything for the first time.

STEP 4: Explanation of Court Process, Fees, and What we can do to Help

The fourth step is explaining what’s next, and what we can do to help. We understand that for most people, this is the first time having any contact with the criminal justice system. You might not be sure what to expect, what will happen in court, how long things will take, how much everything will cost, and whether there is even any hope. Rest assured we will go through every step and answer every question to make sure you understand the process and feel confident in the value we can add to your defense. No matter what the circumstance, if you have been charged we a criminal offence, we know we can help. Give us a chance to tell you how.

What Is BOI Law In Thailand?

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent pulvinar massa eu mi rutrum, ut bibendum justo iaculis. Etiam aliquet dolor id nisl hendrerit aliquam. Sed risus augue, ultrices vitae tellus sit amet, malesuada vehicula velit. Quisque egestas nisi tortor, eu pulvinar nisi aliquet quis. Etiam sed justo lobortis, porttitor magna et, suscipit lectus. Integer eu risus non justo faucibus consectetur. Aenean est odio, tempor vel malesuada eget, scelerisque sed est. Duis et est quam. Curabitur bibendum neque neque, sit amet elementum purus tristique in.

Quisque hendrerit, justo vel aliquet gravida, velit elit ornare mi, ut egestas leo nisi nec lectus. Proin malesuada libero efficitur varius scelerisque. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla eleifend massa sit amet nisl vehicula rhoncus. Morbi nec dolor mauris. Vivamus iaculis luctus tortor tempus ullamcorper. Curabitur eu est semper, tincidunt orci ultricies, commodo lorem. Vestibulum velit libero, ultricies ac fermentum vel, molestie vitae enim. Aenean interdum convallis nunc, ac efficitur nibh venenatis ut. Quisque vel efficitur felis, quis fermentum nisi. Maecenas rutrum lorem quis sem auctor maximus. Quisque nisi mauris, pharetra vitae tincidunt efficitur, feugiat a est. Phasellus eget augue et turpis pellentesque ultricies. Proin pharetra interdum ornare. Cras eget molestie dolor, quis lobortis erat.

Current Policy Board Of Investment

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent pulvinar massa eu mi rutrum, ut bibendum justo iaculis. Etiam aliquet dolor id nisl hendrerit aliquam. Sed risus augue, ultrices vitae tellus sit amet, malesuada vehicula velit. Quisque egestas nisi tortor, eu pulvinar nisi aliquet quis. Etiam sed justo lobortis, porttitor magna et, suscipit lectus. Integer eu risus non justo faucibus consectetur. Aenean est odio, tempor vel malesuada eget, scelerisque sed est. Duis et est quam. Curabitur bibendum neque neque, sit amet elementum purus tristique in.

Quisque hendrerit, justo vel aliquet gravida, velit elit ornare mi, ut egestas leo nisi nec lectus. Proin malesuada libero efficitur varius scelerisque. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Nulla eleifend massa sit amet nisl vehicula rhoncus. Morbi nec dolor mauris. Vivamus iaculis luctus tortor tempus ullamcorper. Curabitur eu est semper, tincidunt orci ultricies, commodo lorem. Vestibulum velit libero, ultricies ac fermentum vel, molestie vitae enim. Aenean interdum convallis nunc, ac efficitur nibh venenatis ut. Quisque vel efficitur felis, quis fermentum nisi. Maecenas rutrum lorem quis sem auctor maximus. Quisque nisi mauris, pharetra vitae tincidunt efficitur, feugiat a est. Phasellus eget augue et turpis pellentesque ultricies. Proin pharetra interdum ornare. Cras eget molestie dolor, quis lobortis erat.

Why Set Up A BOI Company?

100% Foreign Ownership

Permission to have 100% foreign ownership

Visas & Work Permits

Permitted to bring in experts and skilled workers with their families

0% Tax

Up to 15 years exemption of Corporate Income Tax (CIT)

Own Land

Permits foreigners to own land